The Union Budget 2025 has brought major changes to India’s tax system, simplifying compliance and offering significant relief to middle-class taxpayers. A major highlight is that income up to ₹12 lakh is tax-free due to a rebate, increasing savings for many individuals.

In this blog, we will break down the new income tax slabs, compare them with last year’s structure, and analyze how much taxpayers can save.

New Income Tax Slabs for FY 2025-26

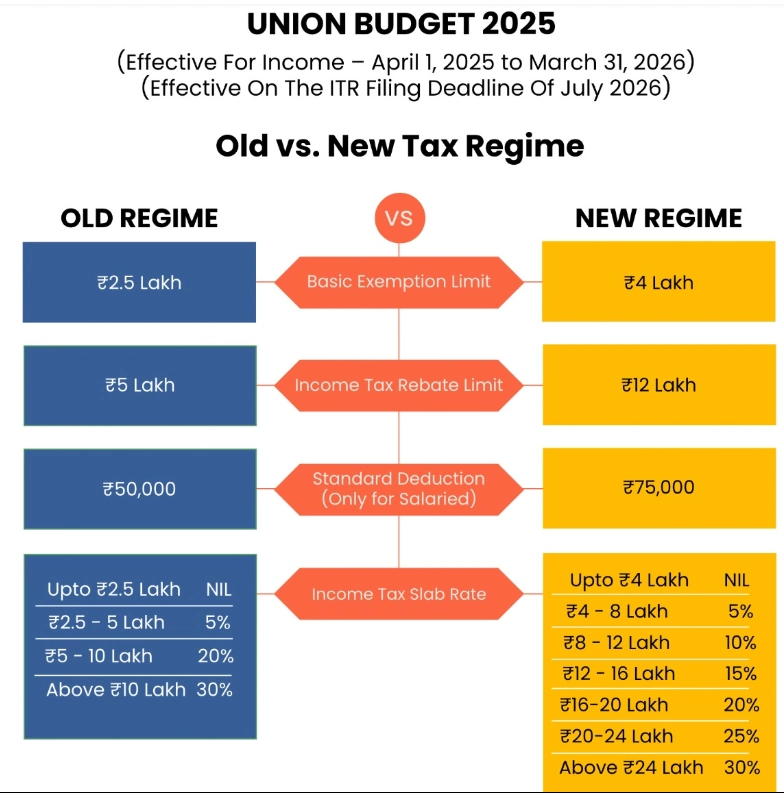

The government has introduced a revamped tax slab system under the new tax regime:

| Income Slab (₹) | Tax Rate (%) |

| 0 – 4,00,000 | 0% (No Tax) |

| 4,00,001 – 8,00,000 | 5% (Rebate – No Tax Payable) |

| 8,00,001 – 12,00,000 | 10% (Rebate – No Tax Payable) |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Comparison of Tax Savings with 2024-25

Let’s compare how much tax you would pay under the current FY and next financial years:

| Income (₹) | Tax Under 2024-25 FY | Tax Under 2025-26 FY | Savings (₹) |

| 8,00,000 | ₹35,000 | ₹0 (Rebate Applied) | ₹35,000 |

| 12,00,000 | ₹80,000 | ₹0 (Rebate Applied) | ₹80,000 |

| 16,00,000 | ₹1,80,000 | ₹1,20,000 | ₹60,000 |

| 18,00,000 | ₹2,40,000 | ₹1,80,000 | ₹60,000 |

| 22,00,000 | ₹3,30,000 | ₹2,85,000 | ₹45,000 |

| 26,00,000 | ₹4,20,000 | ₹3,75,000 | ₹45,000 |

Key Benefits of Budget 2025 for Taxpayers

- Higher Tax-Free Limit

- No tax for incomes up to ₹12 lakh, compared to ₹7 lakh last year.

- This means an individual earning ₹12 lakh doesn’t have to pay any tax at all.

- More Disposable Income

- With the new slab structure, middle-class taxpayers will have more money in hand.

- This encourages savings and investments.

- Tax Simplification

- The new tax system is easier to understand and does not require multiple deductions like before.

- Compliance is now more straightforward for taxpayers.

- Significant Savings

- A taxpayer earning ₹12 lakh saves ₹80,000 compared to last year.

- Those earning ₹16–18 lakh save between ₹60,000 to ₹75,000 annually.

Final Thoughts

The Budget 2025 tax reforms have made the new tax regime more attractive than ever before. With a higher exemption limit and reduced tax burden, middle-income earners stand to benefit the most.

If you’re planning your finances, it’s time to re-evaluate your tax-saving strategies and make the most of these new benefits!

Some of the services that Clevertize provides are:

Creative Services, Performance & Digital Media Marketing, Visual Identity & Branding, Campaign Management & Analysis, UI/UX & Website design, Video creation, Media planning & buying, Chatbot & more.

If Return on Investment is critical for you, talk to Clevertize!

Reach out to us at saumya@clevertize.com!